ADMA Biologics, Inc. (ADMA) shares price almost doubled since company announced that the FDA approved its Asceniv, intravenous immunoglobulin product for the treatment of primary humoral immunodeficiency disease (PIDD), in adults and adolescents ages from 12 to 17.

PIDD is a collective term for numerous diseases that occur due to defects in the body’s immune system such as:

- Wiscott-Aldrich syndrome

- Severe combined immunodeficiency disease (SCID)

- DiGeorge syndrome

- Ataxia-telangectasia

- Chronic granulomatous disease

- Transient hypogammaglobulinemia of infancy

- Agammaglobulinemia

- Complement deficiencies

- Selective IgA deficiency

- And more

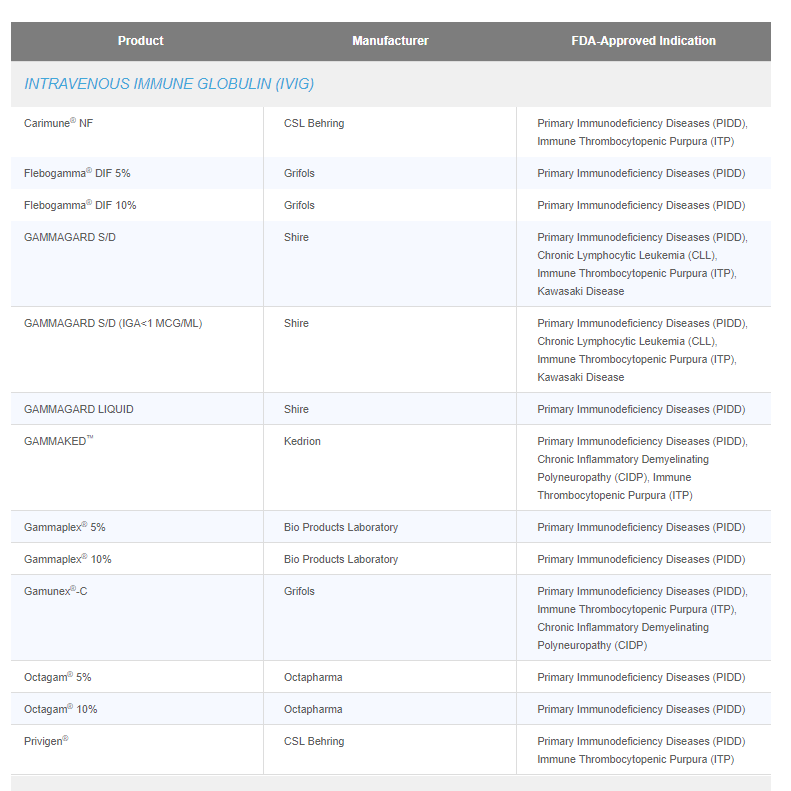

An about 250 thousandths PIDD patients are diagnosed in the U.S. hence Asceniv presents an opportunity to compete with an about 6-8 well established products in this market segment:

What’s portion of this PIDD market pie could be consumed by ADMA? We doubt about any significance of ability to cover this market by Asceniv…

Investors are betting on FDA approval for the ADMA’s intravenous human immunoglobulin (IVIG) product, BIVIGAM. Keep in mind that on December last year the FDA issued a CRL to ADMA pertaining to only the drug substance PAS submission which pertains to chemistry, manufacturing and controls information. Company promised to resolve all issues, even date (April 2nd) has been scheduled for of final FDA decision and, so far, no updates have been published.

Cash: according to the ADMA’s annual statement at December 31, 2018, company had almost half cash and cash equivalents ($22.8 million vs $43.1 million) in comparison with December 31, 2017. Judging to the company plans of manufacturing Asceniv in 2019 the cash could be totally burned out even in Q2 2019 so… public OFFERING is forthcoming.

ADMA has been prepared for this upcoming action and set a ground for:

A proposal to amend and restate the Company’s Amended and Restated Certificate of Incorporation to (i) increase the number of authorized shares of common stock, $0.0001 par value per share, from 75,000,000 shares to 150,000,000 shares, and (ii) remove the Company’s non-voting common stock, $0.0001 par value per share (“non-voting common stock”), which was retired in full on May 14, 2018, and delete all references therein to the non-voting common stock.

Happy trading!

Disclaimer: we shorted ADMA shares on open market during

trading session on April 10th and 11th