“Must-Read” review from BiotechIntel

Novo Nordisk – the world’s largest insulin producer – and major diabetes drug manufacturers – could see BILLIONS in recurring revenue dry up as a small, California-based biotech company advances a technology that promises to change diabetes treatment.

Over $100,000,000 has been invested in developing this super-drug that threatens to make products like Sanofi’s $6 BILLION-A-YEAR basal insulin – ‘Lantus’ – OBSOLETE.

The Company that’s making executives in the world’s largest pharmaceutical firms sweat is Menlo Park, California-based ANTRIABIO, INC. (ANTB)

Here’s why large pharma is worried about ANTRIABIO’s technology:

- Basal insulin is prescribed as a once-daily injection; Antriabio is developing a once-weekly version.

- Big Pharma long-ago realized the need for longer-acting insulin – but the best they’ve been able to produce is a thrice-weekly (3X per week) regimen.

- But even the thrice-weekly regimen, developed by Novo Nordisk, was recently rejected by the FDA for marketing in the United States – the world’s most lucrative diabetes market.

- The FDA has made it clear that it will not compromise patient safety for Novo Nordisk’s ‘longer-acting’ insulin drug.

- Analysts estimate the FDA setback will cost Novo Nordisk BILLIONS and delay launch to 2018 or later, and perhaps indefinitely, because their drug has been linked to heart complications.

- Antriabio’s long-acting basal insulin is developed using a well-validated (PROVEN) and widely-accepted (SAFE) technology call PEGYlation. The company patented use of this technology with insulin, which makes virtually every competitor in diabetes OBSOLETE.

- Market Research suggests that by 2018, sales of insulin will reach $32 BILLION globally, and every pharmaceutical company seeing revenue dry up because of expiring patents will want a piece of this ENORMOUS market.

- In 2012, patent expiration cost pharmaceutical companies more than $34 BILLION in sales; the loss will balloon to $147 BILLION by 2015.

- If global pharmaceuticals companies want to remain competitive, they’ll need to find disruptive technologies with extensive patent life targeting large markets, and partner with or outright acquire such technologies. In other words, big pharma is seeking technologies like Antriabio’s long-acting basal insulin – which to them is worth BILLIONS OF DOLLARS.

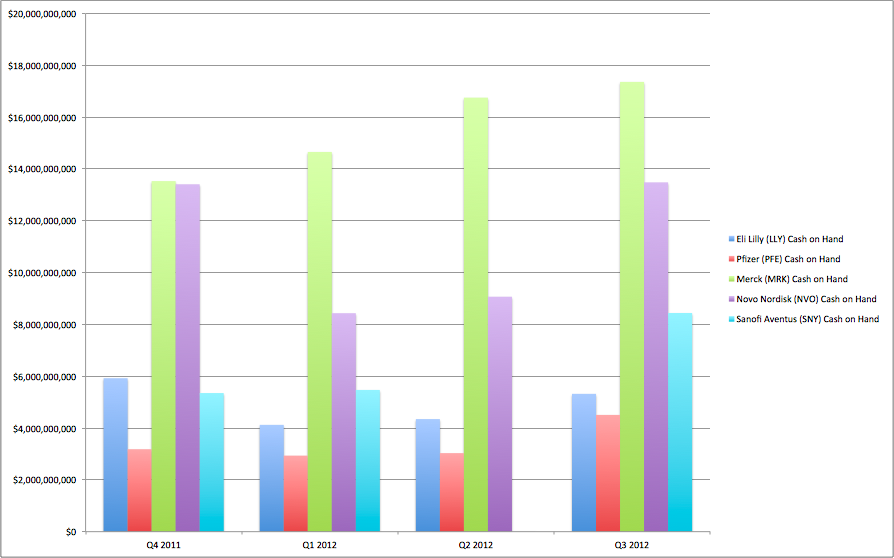

Big pharma is sitting on the largest stockpile of cash seen in history – cash that was accumulated selling lucrative drugs that will now go off-patent and cause losses to the tune of $147 BILLION in 2015 alone.

However, big pharma isn’t sitting idle. Furthermore, executives at the world’s largest pharmaceutical companies recognize their livelihood is at stake.

Big Pharma has progressively been acquiring disruptive technologies with long patent life targeting large markets like diabetes.

Last year, Bristol Myers Squibb spent $7 BILLION to acquire Amylin and their portfolio of GLP-1, a type of insulin prescribed to patients to help treat type-2 diabetes.

The acquisition of Amylin sparked a BIDDING WAR among:

- AstraZeneca (AZN),

- Pfizer (PFE)

- Merck (MRK)

- Sanofi Aventus (SNY)

- Bristol Meyers Squibb (BMS)

This clearly proves that big pharma is not only interested but DESPERATE for products that will help them remain competitive.

What’s incredible is that Antriabio has an even better version of Amylin’s once-weekly GLP-1 drug – a super-long acting, once-monthly treatment.

To recap:

- Novo Nordisk + Sanofi saw sales north of $8 BILLION just on their daily basil insulin product

- Antriabio is developing a once-weekly version – called AB101 – that promises to make these existing products OBSOLETE

- Bristol Myers Squibb paid $7 BILLION for Amylin’s once-weekly GLP-1 insulin drug in 2012

- Antriabio is developing a once-MONTHLY version of the GLP-1 drug – called AB201 – that sees annual sales of >$1 Billion.

We believe Antriabio will trade upwards as Big pharma continues to see their patents expire and suffer billions of dollars in recurring sales losses, Drug makers struggle to create SAFE, long-acting insulin products, Antriabio advances its technology and Big pharma eventually bids to acquire Antriabio to eliminate the threat this small company poses and equally to secure a future worth BILLIONS to the big pharma companies who have established sales channels and distribution in diabetes care.

We like Antriabio as a company that is undiscovered by investors, boasts excellent management with a track record of success in biotech, and has strong intellectual property (IP) and patent life.

Last year, we saw Organovo, the world’s first 3D Bio-Printing company quietly emerge as a public company. It debuted at $1.65 and rally to $11, before settling mid-range. Organovo successfully raised more than $25MM and is now weeks away from listing on a national exchange, likely the NASDAQ. Moreover, it is one of the most active issues traded over-the-counter. Organovo, like Antriabio, was once completely unknown to investors, but later emerged as one of the best-performing equities of 2012.

Organovo’s disruptive technology in cell-based research suggests Antriabio should perform on par, if not better, during the course of this year, and beyond.

We anticipate Antriabio will be one of the best performing equities in 2013, supported by fundamentals that will eventually drive a large pharmaceutical company to acquire them at a huge premium to their current price. For some more information on Antriabio, view their overview.

An affiliate of PennyStockHaven.com received twenty thousand dollars per month for providing consulting and advisory services to AntriaBio in the past and may receive cash and/or restricted stock in the future. This compensation may affect the objectivity of our profile of the company. PennyStockHaven.com own shares acquired in the open market and may sell these shares at any time. You should do your own homework and consult an investment professional before making any investment decisions. Read our full disclaimer here.