Chart/Volume Play – be sure that you read Curis’s PR beforehands:

Curis, Inc. (CRIS), a biotechnology company, announced on September 14th, 2014 the pricing of an underwritten public offering of 20,000,000 shares of its common stock (the “Offering”). The Offering is expected to close on or about September 18, 2017, subject to customary closing conditions.

Robert W. Baird & Co. Incorporated (“Baird”) is acting as the sole underwriter for the Offering. Curis has granted Baird a 30-day option to purchase up to an additional 3,000,000 shares of common stock sold in the Offering, on the same terms and conditions.

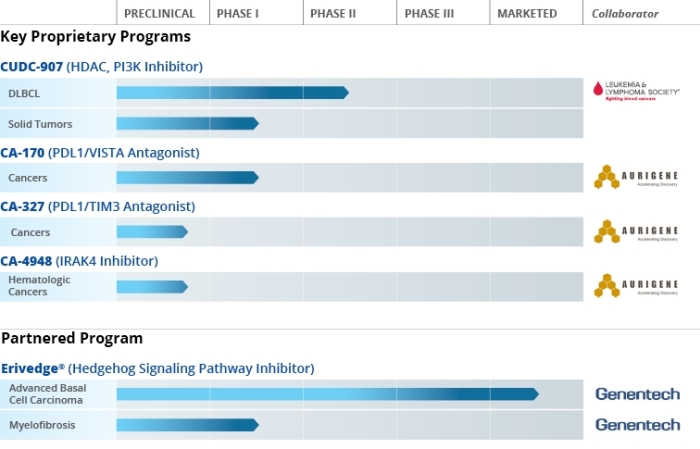

Curis intends to use the net proceeds from the Offering, together with its existing cash and investments, to continue development of CUDC-907, as well as CA-170, CA-327 and CA-4948 in collaboration with Aurigene Discovery Technologies Limited (“Aurigene”), and any additional product candidates for which it exercises its option to exclusively in-license from Aurigene, to fund potential acquisitions of new business, technologies or products that it believes will complement or expand its business, and for general working capital and capital expenditures.

A few bits of info (just for curious traders)

CUDC-907 is a synthetic, orally-available, small molecule that potently inhibits the activity of histone deacetylase, or HDAC, and phosphotidyl-inositol 3 kinase, or PI3 kinase enzymes1. In 2013, Curis initiated a Phase 1 clinical study to determine the maximum tolerated dose, recommended Phase 2 dose (RP2D) and preliminary anti-cancer activity of CUDC-907 monotherapy in patients with relapsed or refractory lymphomas or multiple myeloma2. An analysis of the data from a total of 75 patients in this study was presented at the European Hematology Association’s annual meeting in June 2016. In this Phase 1 trial, 9 objective responses (3 complete responses and 6 partial responses) were reported in 21 response-evaluable patients out of a total of 25 patients with relapsed/refractory DLBCL enrolled in the study.